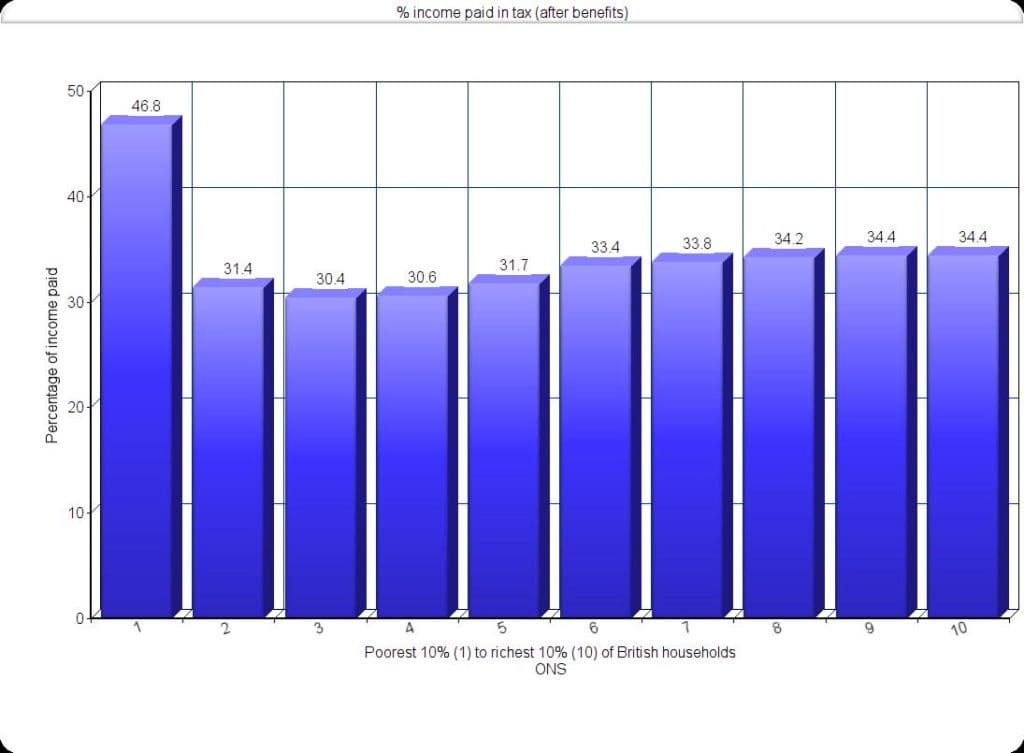

Despite the Conservative government claiming we are ‘all in it together’, new figures from the Office for National Statistics (ONS) show otherwise.

According to an analysis of official ONS figures by anti-poverty charity The Equality Trust, the lowest paid tenth of households in Britain have been hit hard in recent years. Between 2014 and 2015, these citizens paid 47% tax on their income. In 2012/2013, they were paying 43%.

The richest tenth of British society, meanwhile, paid only 34% tax on its income in 2014/2015. This was down from 35% in 2012/2013.

This chart shows exactly what’s going on:

Equality Trust Director John Hood was shocked by these revelations, saying:

It can’t be right that millionaires can pay a smaller proportion of their income in tax than their cleaners.

Shadow Chancellor John McDonnell argued that the figures showed the “unfairness at the heart of this Tory government”, and:

further proves that we are clearly not all in it together as George Osborne claims

The ONS data analysed by The Equality Trust included all taxes, including indirect taxes such as VAT and alcohol duty.

Why is this happening?

Short answer – Tory policies.

Firstly, the 100 biggest companies in the UK were allowed to pay only 23% tax on their profits in 2015, while small and medium-sized companies were hit hard by government investigations into the underpayment of VAT. No bias there, clearly.

Then, there’s the fact that the Tories want to privatise the NHS, sell off more public assets than ever before, all while receiving donations from hedge funds, property developers, and tax-avoiding corporations. Again, obviously no vested interests.

Finally, on the issue of tax avoidance, neither David Cameron nor George Osborne appear to be truly committed. Cameron’s own tax scandal aside, Osborne claimed in January 2016 that making Google pay less than 3% corporation tax was a massive success. But as French authorities raid Google’s headquarters in Paris over alleged tax avoidance to the tune of €1.6bn, it seems Osborne did, in fact, gave the company an easy ride (it could actually owe us six times more than it’s agreed to pay).

355 economics professionals and academics from around the world have slammed such inaction on tax avoidance, writing a letter earlier in May insisting that:

The existence of tax havens does not add to overall global wealth or well-being; they serve no useful economic purpose.

But while the richest 0.1% in the UK pay themselves an average of over £1m a year and 90% of citizens receive an average of only £12,969, the Conservative government continues to give big breaks to big business while making life harder for the majority of citizens through austerity cuts. Is this really the future we want for the UK?

Get involved!

– See other Canary articles on inequality.

– Listen to what the experts have to say about the causes, effects, and solutions to inequality.

– Join the campaign for global tax justice.

– Support UK Uncut or get involved with other organisations campaigning against our current system of socialism for the rich and capitalism for the poor.

– Support The Canary so we can keep holding the powerful to account.

Embedded image via the author

Featured image via Pixabay