New research published by the Tax Justice Network shows that the UK and UK territories lead the world in providing havens for corporate tax avoidance. And Labour leader Jeremy Corbyn has slammed the ruling Conservative Party’s role in the scam, saying:

Every penny lost to tax avoidance is money not being spent on our NHS and our schools.

Yet the Conservatives simply turn a blind eye to the super rich avoiding paying their taxes.

The UK bears “the lion’s share of responsibility”

The ‘Corporate Tax Haven Index’ identified:

the UK and a handful of OECD countries as the jurisdictions most responsible for the breakdown of the global corporate tax system – with the UK bearing the lion’s share of responsibility through its controlled network of satellite jurisdictions.

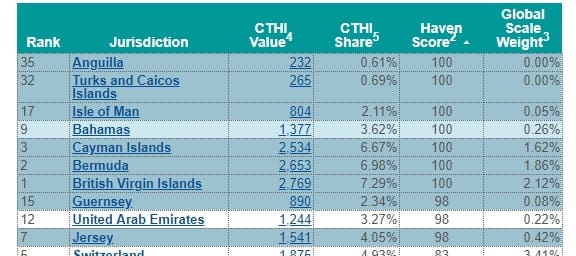

Anguilla, the Turks and Caicos Islands, and the Isle of Man – all UK overseas territories or crown dependencies – topped the ‘Haven score’ list. A shocking total of eight UK territories, meanwhile, feature in the top ten of this list.

The haven scores are calculated based on 20 different indicators, and the full methodology is available here. Other UK territories or dependencies such as the Cayman Islands, Jersey, and Guernsey are also prominent locations for tax avoidance.

“By far the world’s greatest enabler of corporate tax avoidance”

The Tax Justice Network noted that:

An estimated $500 billion in corporate tax is dodged each year globally by multinational corporations – enough to pay the UN’s under-funded humanitarian aid budget 20 times over every year.

It added:

The UK with its corporate tax haven network is by far the world’s greatest enabler of corporate tax avoidance and has single-handedly done the most to break down the global corporate tax system, accounting for over a third of the world’s corporate tax avoidance risks as measured by the Corporate Tax Haven Index.

On a national scale, $500bn equates to more than three times the entire NHS budget.

According to the Guardian, UK shadow chancellor John McDonnell called the findings “embarrassing and shameful”. And he said:

The only way the UK stands out internationally on tax is in leading a race to the bottom in creating tax loopholes and dismantling the tax systems of countries in the global south.

The rot has to stop. While Tory leadership hopefuls promise tax giveaways for the rich, a Labour government will implement the most comprehensive plan ever seen in the UK to tackle tax avoidance and evasion.

Corporate theft “enough to pay the UN’s under-funded humanitarian aid budget 20 times over every year”

The findings detail corporate theft on an unprecedented scale. And as economist Rutger Bregman claimed:

it’ll probably only get worse with Brexit

Historian Mark Curtis, meanwhile, pointed out how tiny UK aid was in comparison to the money corporations dodge with the help of British territories:

Lost revenues from world tax avoidance ($500bn) for which UK/territories is more responsible than any other country, are 28 x more than UK aid ($18bn). Idea that UK is a net contributor to “international development” is a key pillar of UK propaganda system https://t.co/p3yoWiMtPT pic.twitter.com/NegEVcWgXn

— Mark Curtis (@markcurtis30) May 29, 2019

Corporate tax havens represent one of the greatest scams in human history. They are a parasitic feature of a parasitic system, and the UK is very much the bloodsucker’s head.

This research must be the first port of call against anyone arguing there’s no money for aid or welfare programmes.

Featured image via Rwendland/Wikicommons and Tiocfaidh ár lá 1916/Flickr